E-Invoicing: First Comes the Hard Work, Then Comes the win – Part 1

Table of contents:

- The current status of e-invoicing in Europe

- Competencies required to tackle e-invoicing

- What kind of information needs to be gathered prior to the e-invoicing mandate?

14 billion euros. According to SZ, Germany’s largest broadsheet newspaper, this is a huge amount of money that Germany loses every year through VAT fraud.1 In addition, Germans use around 6 million tons of paper per year for administrative work, according to the German Nature and Biodiversity Conservation Unit (NABU).2 And these are just two of many reasons for the upcoming e-invoicing mandate. This directive is an important step towards digitization, not only for Germany but for the whole of Europe. Instead of paper and PDF invoices, structured and machine-readable data records will be exchanged. This enables invoices to be processed electronically, automatically and without discontinuity of media.

The current status of e-invoicing in Europe

In recent years, most European countries have introduced an obligation for the use of e-invoices in the B2G sector (Business-to-Government).3 However, this has led to a variety of different requirements, formats, transfer methods paths and channels. Even within Germany, the different regulations vary from state to state: each federal state decides for itself which transmission method is permitted. Some of them only allow transmission via PEPPOL, while others use alternative transmission methods.4

Future developments

In the future, the obligation for the use of e-invoices will be extended to the B2B sector (business-to-business) in most European countries.3 The regulations and requirements differ significantly from those in the B2G sector. There will also be considerable differences in Germany in this respect, which are discussed below.

Introduction of the e-invoicing mandate

A central motivational reason for the introduction of the e-invoicing mandate is the fight against VAT fraud. According to Europol, the EU loses 50 billion euros a year through so-called VAT carousels, in which companies receive unlawful VAT refunds by trading goods within the EU.1 Another reason for the e-invoicing mandate is the sustainability aspect: according to ecosio.com, the average office worker uses around 10,000 sheets of paper per year. Let's take a look at the environmental impact: roughly 10 liters of water are needed to produce a single sheet of paper.5

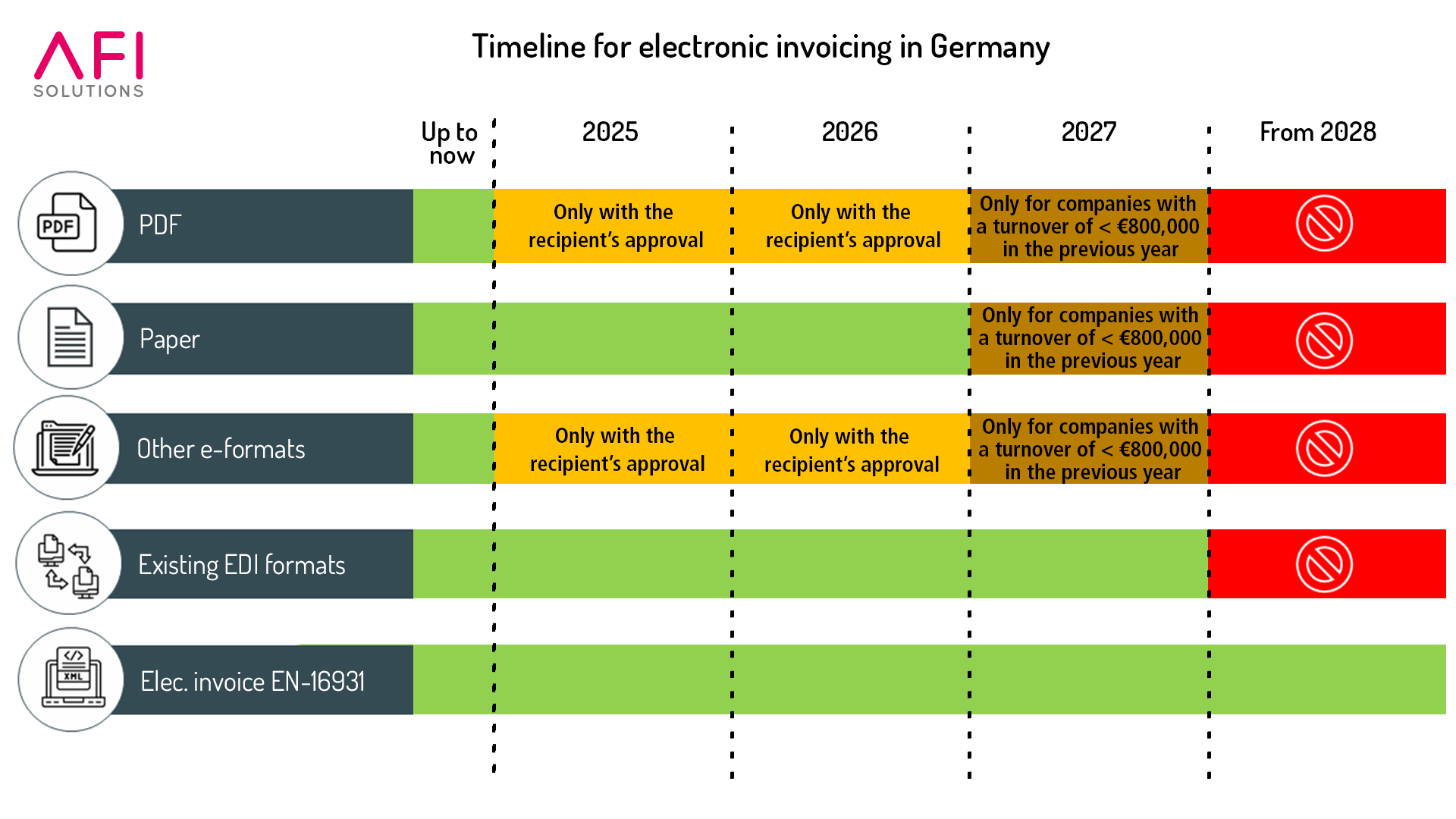

According to the current status, the following rules will apply in Germany (see Figure 1):

- Until the end of 2024, invoices may still be issued as PDF files, in paper form, in varying electronic formats or as existing EDI formats.

- This will change on 1 January 2025: from this date, PDF invoices and other electronic invoice formats may only be issued with the consent of the invoice recipient (up to and including 2026).

- From 2027, this exception for paper and PDF invoices as well as invoices in different e-formats will only apply to small businesses with an annual turnover of less than €800,000.

- Existing EDI systems can be used for invoicing without restriction until the end of 2027.

- From 1 January 2028, all companies without exception are obliged to use e-invoices (EN-16931) for invoicing.

Fig. 1 E-invoicing regulations in Germany

Current e-invoicing challenges in Germany

There is currently neither a central portal in Germany nor a specific requirement for the transmission method of e-invoices (e.g., PEPPOL).6 Without such a system, e-invoicing in Germany will only be able to make a limited contribution to combating VAT fraud. Monitoring and tracking transactions is much more complicated in a decentralized structure. Corresponding changes are to be expected in the coming years.

European models

In some European countries, the e-invoicing mandate for B2B companies has already been introduced or is being planned. Italy, for example, has been using a V-model for domestic invoices and a reporting model for foreign invoices for several years. Other countries, such as Poland, rely on the so-called Y-model (find out more about the models here).

Competencies required to tackle e-invoicing

When dealing with the topic of e-invoicing, it quickly becomes clear that various areas of expertise need to be covered. This involves not only the introduction of e-invoicing, but also its processing. Specific skills and knowledge are required to successfully master the process:

Mapping:

Each format is to be mapped individually. This means that the specified fields of the e-invoice need to be filled in accurately and the data needs to be read correctly. This is a frequent challenge, as the descriptions of the formats are often only available in the respective national language. For the Polish format, for example, there is a 300-page PDF file in which all fields are described - but only in Polish.

Technical modifications:

Experience has shown that each format undergoes technical modifications several times a year, resulting in different versions of the formats. It is possible that outdated versions will no longer be accepted by central portals. For this reason, it is important to follow the announcements of the respective authorities and implement them at an early stage to ensure that the invoices continue to be accepted.

Conversion:

An appropriate software component or service provider is required for conversion to or from the specified format.

Storage addressing:

When sending e-invoices, various pieces of information will need to be maintained in the future: the recipient ID (route ID, PEPPOL ID,...) or the transmission method (PEPPOL, API,...). As a rule, the specialist department should be able to process this information itself. A user-friendly interface is required for storage, which is preferably integrated into the ERP system used.

Access Points:

There are different access points for the various e-invoicing networks. Some are connected via API, others require certified access, such as a “PEPPOL Access Point”.

Legibility:

A look-alike document ought to be created from the e-invoice data record so that the incoming invoice verification can check the original invoice.

Monitoring:

An interface for the monitoring of invoices should be available for both invoice receipt and outgoing invoices. Some portals provide feedback as to whether the e-invoice has the correct format and whether all mandatory fields have been filled in correctly. This feedback needs to be visible in the invoicing party's system.

ERP integration:

ERP integration is necessary to ensure an end-to-end integration of the e-invoice into the company's internal processes. Appropriate expertise from the areas of e-invoicing, IT and ERP is to be pooled.

What kind of information needs to be gathered prior to the e-invoicing mandate?

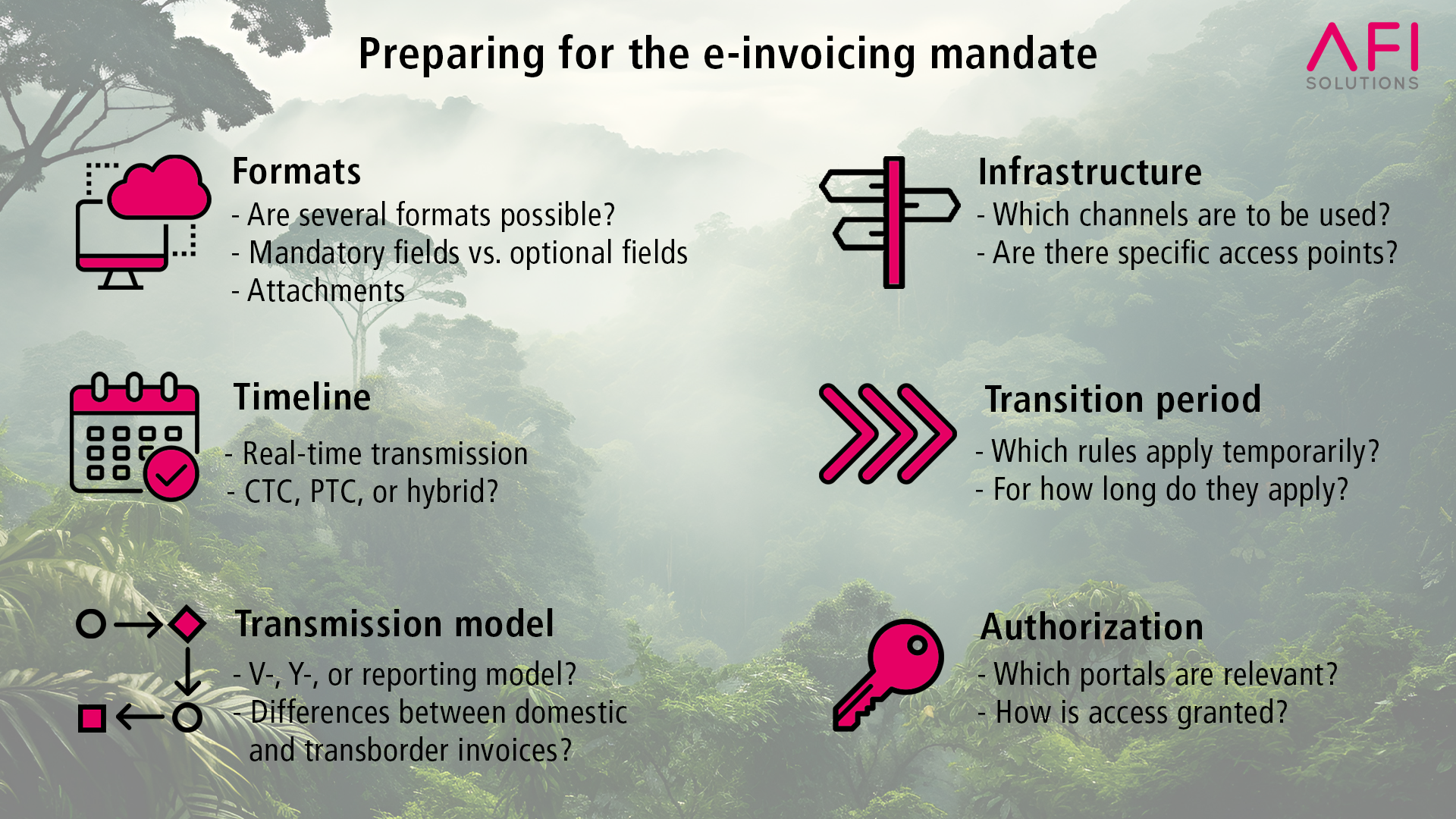

In order to be optimally prepared for the e-invoicing mandate, it is important to consider the requirements of the different countries separately. As the obligation is not yet mandatory in all European countries7, the initial focus will be on those countries where the obligation already exists. The following diagram can be used to check the relevant information (see Figure 2):

Formats

- Are multiple formats possible?

- How does the coordination between the invoicing party and the invoice recipient work?

- Which fields are mandatory, and which are optional?

- Are there attachments?

Timeline

- Is the transmission in real time?

- CTC, PTC or Hybrid?

Which transmission model is used?

- V-, Y-, or reporting model?

- Are there any differences between domestic and transborder invoices?

- May the Y-model be used?

Infrastructure

- Which channels need to be used?

- Are there special access points?

Transition periods

- Which rules apply temporarily?

- How long do they apply?

Access / authorization

- Which portals are relevant?

- How is access / authorization granted?

- How can service providers be authorized?

Fig. 2 Advance information regarding the e-invoicing mandate

The information required by the business partners is then to be determined. This includes, among others

- Address ID

- Channel

- Transfer method

- Format

- Special features

Depending on the country, recipient IDs may be required for correct addressing or the currentness of the VAT ID needs to be checked. This is particularly important as addressing in invoice dispatch is controlled by the recipient's VAT ID in some countries.

It is also necessary to check whether agreements need to be made between the sending and receiving parties.

Existing internal processes need to be tested for compatibility with future requirements. Service providers should also be involved at an early stage in order to be able to cope with the large number of incoming requests as deadlines approach.

What this all amounts to is that the e-invoicing mandate in Europe is driving digitization and curbing VAT fraud.

Despite technical challenges and language barriers, it provides the opportunity for more efficient and automated invoicing processes. Careful preparation and extensive know-how are essential for a successful changeover.

AFI Solutions can provide you with comprehensive expertise and individual solutions to help you master the e-invoicing mandate. Please contact us for personal and non-binding consulting.

contact us now

+49 711 26892 - 0

Read Part 2 E-Invoicing: first comes the hard Work, then comes the Win to find out how you can successfully master the topic of e-invoicing and what this means for your invoicing processes.

Sources:

1https://www.sueddeutsche.de/wirtschaft/umsatzsteuerbetrug-karussellgeschaefte-eusta-1.5706610

2https://www.nabu.de/umwelt-und-ressourcen/ressourcenschonung/papier/30377.html

3https://ecosio.com/en/blog/b2b-e-invoicing-in-germany-to-become-mandatory-in-2026/

4https://en.e-rechnung-bund.de/

5https://ecosio.com/de/blog/interessante-fakten-zum-papierlosen-buero/

6https://www.e-rechnung-bund.de/ubertragungskanale/

7https://www.verband-e-rechnung.org/archiv/fachartikel/europa-e-invoicing-pflicht/