How Mercer Rosenthal Is Going All Digital with the Purchase-To-Pay Process!

Table of Contents:

- Companies often start digitization with only one process

- Finding suitable digital solutions for the P2P process in SAP

- Completely digital purchase requisition and ordering processes

- Creating a digital document base

- How order confirmations affect the high data quality of incoming invoices

- Pandemic, digitization and working from home

- Talking about archiving and auditing

- 6 recommendations for companies seeking to automate their P2P processes

- Customer-supplier relations

- Conclusions: End-to-end purchase-to-pay processes have a clear advantage

Which purchase-to-pay process is considered the most important for digitization?

The Irish writer George Bernard Shaw was once asked which of three factors is most certain to lead to success: work, money, or intelligence. Shaw responded with a counter question, wanting to know which wheel is the most important to mount a tricycle and get ahead.

The world's largest pulp manufacturer Mercer Rosenthal gives a similar answer with regard to the digitization of the purchase-to-pay process in SAP. Rainer Ackermann, project manager at Mercer Rosenthal, explains in which way:

"Lean and efficient processes are absolutely essential if we are to remain a leader in the market. That's why we felt that the only right way to go was to automate the complete processes from requirement creation to order confirmation to incoming invoices at the best possible rate."

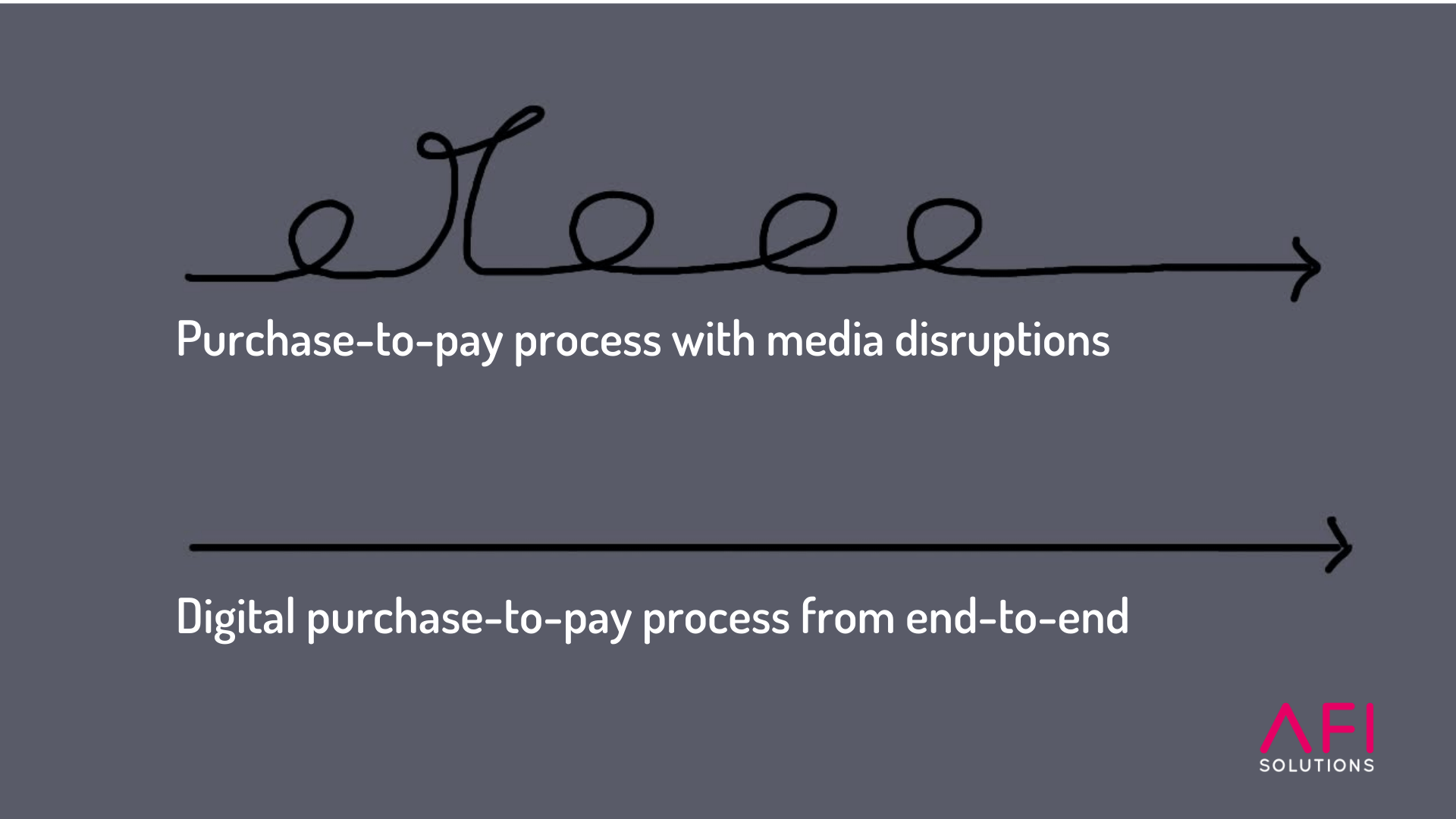

The purchase-to-pay process, often also referred to as the procure-to-pay process, describes the entire process from purchase to payment. Therefore, it includes all processing steps from requirement notification to purchase order and order confirmation to invoice processing.

This blog article reveals the benefits that digitization now brings throughout the purchase-to-pay process and the advice Mercer Rosenthal is giving to other companies facing similar decisions.

Companies often start digitization with only one process

Mercer Rosenthal tends to be the exception when it comes to taking a comprehensive look at the optimization of the purchase-to-pay process. This is because many companies often start digitization with invoice processing. According to this year's trend survey by IT-Onlinemagazin, almost 70 percent are already on the digital path.

"But if you only look at the invoicing process, you're wasting a lot of performance momentum. That's because every unnecessary manual transaction slows down market performance. Companies that optimize the entire purchase-to-pay process exploit the full potential. Because every digital solution in a purchase-to-pay sub-process ensures that the data quality for the next process is higher," explains Andreas Rapp, specialist at AFI Solutions and also Mercer Rosenthal's direct contact throughout the project.

Finding suitable digital solutions for the P2P process in SAP

Mercer Rosenthal also had to deal with many manual transactions and media disruptions prior to launching the P2P offensive. Although digital workflow software was available, it was not integrated in SAP and led to complex interfaces. This, in turn, created a lot of monitoring effort for the IT department. So it was about time to make a change. The task was to find a supplier whose portfolio covered the entire purchase-to-pay process and was seamlessly integrated in SAP.

AFI Solutions quickly came to the attention of Mercer Rosenthal and scored with convincing references, as Mr Ackermann reports: "Another key point in the decision-making process was the opportunity to examine a reference installation that roughly met our requirements. We wanted to know whether the solutions for the purchase-to-pay process also deliver in practice what they promise in theory."

AFI Solutions stood out and implemented a comprehensive and cross-site process harmonization of the P2P workflow together with the pulp manufacturer.

Completely digital purchase requisition and ordering processes

Handouts that are passed through departments to the purchasing department no longer exist at Mercer Rosenthal. These days, the staff enters requirements digitally by means of the purchase solution which is seamlessly integrated in SAP and also available to non-SAP users. The connection of OCI catalogs to the solution additionally increases data quality: the values from the internet catalog are transferred directly to the SAP purchase requisition when the order is placed. Because of the electronic transmission of texts and order add-ons, there are no errors or media disruptions.

The purchasing department can view all purchase requisitions clearly in the central solution Monitor - directly in SAP. This allows the processing status to be tracked at any time. In addition, a first approval level by the requester accelerates the pace of the approval process. This means that every internal requirement is assigned to an account by the requester himself. The purchasing and accounting departments no longer have to worry about this, as the project manager also confirms:

"The approval process for purchase requisitions is still very complex for us, but it has been simplified considerably compared to the past. Among other things, this is ensured by this first approval level, which is seamlessly integrated into SAP and noticeably speeds up the transaction."

Creating a digital document base

In order to provide initial harmonization of document receipt in the follow-up process, Mercer Rosenthal has asked all vendors to send incoming order confirmations and invoices only digitally as e-mails with PDF attachments in the future. The majority of customers are complying with this request.

"Digital receipt of the documents is the basis for automated processing in the purchase-to-pay process. High accuracy of optical character recognition also plays a role here, which in our case was already at 90 percent without training. This significantly minimizes the effort required for modifications and checks in purchasing and accounting," Mr Ackermann explains.

Apart from digital document capture and recognition, other functions within the solution also reduce manual effort, "above all, the feature in AFI Confirmation for automatic maintenance of info records at the push of a button makes the work of data maintenance noticeably easier for the purchasing department," continues the project manager.

How order confirmations affect the high data quality of incoming invoices

Reducing the error rate when processing order confirmations is a real driver of efficiency in the purchase-to-pay process. If there are variances between the order confirmations and the purchase order, system assistants warn the purchasing department. As a result, any variance is automatically recorded and the order data corrected. And this is exactly the point which makes every process management heart sing. Because that is where data errors are eliminated and the doors are opened to the best possible automation of the subsequent P2P processes.

If this cleanup step is missing, the purchase-to-pay process stumbles and slows down. In the end, purchase orders often have variances. If these are not recorded, companies only notice that something is wrong upon invoice receipt. And sorting this out can take time. Therefore, digital processing of incoming order confirmations is a real booster at this point in the P2P process, as Andreas Rapp explains:

"Invoice processing is at the farthest end of the purchase-to-pay process, where the cash flows and discounts are to be secured. This means that if the purchase requisition already comes in properly, a solution for order confirmations ensures that variances from the purchase order are resolved. At that point, the data quality of the incoming invoices is already so high that there is basically no longer any need for an approval process."

Mercer Rosenthal is now experiencing this increase in data quality on a daily basis. The upside is that everyone benefits, as Ackermann explains:

"We now have increased transparency throughout the purchase-to-pay process: for requesters, the purchasing department, the finance department, and the approvers. In addition, all AFI solutions have a similarly structured Monitor. So anyone working with the AFI Purchase Monitor will easily find his or her way around the AFI Confirmation or Invoice Monitor. This is a great thing, especially for buyers who are involved in many sub-processes of P2P."

Pandemic, digitization and working from home

The pandemic has brought the urgency and benefits of digital operations into sharper focus as a recent 2021 survey conducted by the digital association Bitkom also confirms. Two-thirds (64 percent) of the 500 companies surveyed stated that digital technologies are contributing to coping with the pandemic. Mercer Rosenthal can also confirm this, as no adjustments were necessary in the company during the increased time spent working from home, as seamless processing had already been ensured beforehand.

After all, each of the SAP add-on solutions used archives the extracted documents in the electronic archive at an early stage. The information is then available directly in SAP to authorized persons digitally and from any location. This in turn accelerates access and reduces internal processing times.

Talking about archiving and auditing

Andreas Rapp emphasizes the importance of the digital corporate archive before going on to optimize corporate processes: "Our solutions directly store documents in the corporate archive via the ArchiveLink. We naturally comply with the principles of proper accounting in this respect and assume that our customers have an electronic archive."

In this context, people often ask whether the purely digital archiving of incoming invoices is also accepted by auditors. Rapp continues: "Aside from the fact that large auditing firms use our solution for incoming invoices, archiving is only one part of the process when it comes to auditing. Auditors look at the entire process as well as the infrastructure. For example, who is allowed to access the server, who is allowed to access the archive, which archive system is involved. In Mercer Rosenthal's case, it would be the AFI invoice solution. If companies wish to play it safe, process documentation is often recommended. But our experience shows that auditors are much more open to an accounting solution today than they were 10 years ago.

Therefore, process documentation is often not even necessary if the processes are well explained. Our customers receive a functional specification that describes the entire process. It describes, for example, what the workflows look like, how the approval processes work, or whether there is a four-eye principle. Such a document also helps during auditing."

6 recommendations for companies seeking to automate their P2P processes

In the meantime, Mercer Rosenthal has been using the solutions within the purchase-to-pay process for some time and has already gone through the implementations of the SAP add-ons for purchase requisitions, order confirmations as well as incoming invoices.

Therefore, it is only natural to ask the project manager for advice for companies that are currently facing similar challenges as Mercer Rosenthal did back then. Rainer Ackermann summarizes six points that Andreas Rapp outlines:

- Involve all relevant departments before starting the project

This ensures that, on the one hand, all important transactions are considered during project implementation and, on the other hand, it promotes employee acceptance of the transformation.

- Comprehensive documentation of the status quo, especially of the special features

"What", "who" and "how"? In order to identify where there is potential for improvement, it is essential to document the status quo. Documentation is always a guide for finding a solution.

- Checking internal processes for possible simplifications

Documentation is followed by a check of the transactions. Often, there are approval processes that have evolved over time, for example, and are now basically unnecessary. This is the ideal time to reconsider and adjust them.

- Reliance on the supplier's experience in the project implementation strategy

AFI Solutions has made suggestions for reducing the project duration and, accordingly, the costs. For example, through the specific use of AFI experts for subtasks.

- Explicit definition of all requirements for the vendors

This includes, for example, the e-mail layout, the layout of the PDF attachment, or the use of an invoice or attachment separator. At this point, it can also be specified that, for example, the company's own purchase order numbers must be included as a reference on all vendor documents.

- Internal planning and performance of extensive tests before go-live

This does require staff resources, which can become quite complex when integrated into the project plan. But even though the tests are costly, it is the wiser decision in any case. After all, no one really wants to smooth out a large amount of errors after go-live.

Customer-supplier relations

It is very beneficial if companies identify what they really need before embarking on a project - especially in the case of such a comprehensive initiative as the automation and digitization of the purchase-to-pay process. For this purpose, an analysis of the status quo and the elaboration of the objectives is the central theme of the P2P project. Some suppliers also provide workshops for this purpose, in which they define these aspects in collaboration with the customer.

Therefore, the supplier relationship and a few other aspects for the project should not be underestimated, as Andreas Rapp explicitly emphasizes:

"The focus in such projects is on the solution, of course. Nevertheless, the interaction between customer and supplier also plays a major role. This is not a short tête-à-tête after all as we are entering into long-term relations and the chemistry needs to be right. The company should also make sure that the supplier has a suitably large team to ensure the performance of the solutions. Not forgetting: the entire solution portfolio also has to work for SAP S/4HANA. This means that companies which still opt for a solution under SAP ERP are also on the safe side when switching to SAP S/4HANA."

Conclusions: End-to-end purchase-to-pay processes have a clear advantage

"Digitization of business processes has long since ceased to be a nice-to-have and should be at the top of the agenda," says Andreas Rapp.

This is exactly what Mercer Rosenthal has set out to do because the processes from purchase order to payment are interlinked in the purchase-to-pay process since they are geared to each other. However, the fact is that the transactions are often not digitally interconnected in practice. The pulp manufacturer recognized this and went all out. The success proves Mercer Rosenthal right, as Rainer Ackerman concludes:

"Starting with the internal purchase requisition through the processing of incoming order confirmations as well as incoming invoices, we now benefit from end-to-end efficiency in the purchase-to-pay process. From our point of view, the processes are automated to perfection. Staff members are spared unnecessary manual tasks, and the transparency makes work easier. Since we have optimized processes that are interlinked, the data quality is growing exponentially. We are very satisfied. For this reason, we will soon also integrate the AFI solution for digital travel and expense processing into our SAP system."